Protect Your Family For As Low As $.65/Day

$3,000-$50,000 of Whole Life Insurance

- No Medical Exam

- NO Waiting Periods - Immediate Death Benefit

- Level Whole Life - Your Payment and Coverage amount remain the same for life

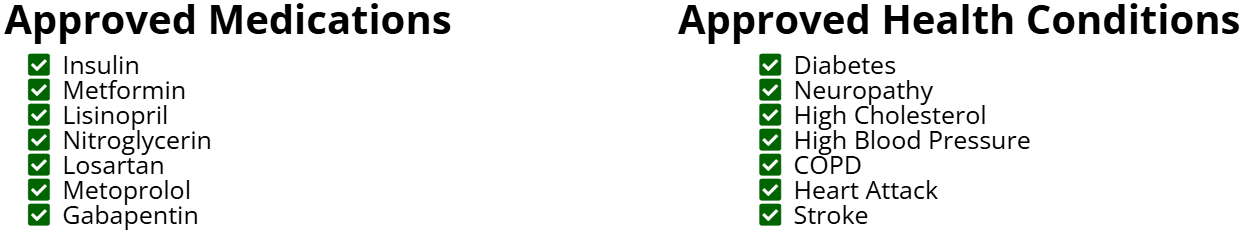

You may qualify for these cheaper policies if you have or ever had any of the following Health Conditions. You can also qualify if you have ever taken any of these Medications

You consent to receive phone calls and SMS messages from Austin to provide updates and information regarding your business with Final Expense Solutions, Senior Benefits Advisors, Burial Life Group. Privacy

Protect your Family from the Financial Burden of Taking Care of your Final needs

Expenses After Death

- Funeral Service

- Medical Bills

- Debt

- Loss of Income

- Inability to pay rent

Loss of Income

If you pass away, will your Family members or other Household residents be able to afford to maintain their living expenses? Will they have to move immediately?

Is there a Waiting Period?

NO - There is an immediate death benefit for all Final Expense plans, and you are covered for the full face amount Day 1 if you pass away from any Accidental Death.

I can't Make a Payment Today

You do NOT need to pay anything to Apply and get Approved. We can set policies to start on a future date such as the 1st or 3rd of the following month to co-incide with Benefits payments. 2nd and 3rd Wednesday's or any other dates too!

What factors affect the cost of final expense insurance premiums?

The cost of final expense insurance depends on several things such as your:

Age and Gender – The older you are when you apply, the higher the premiums, since insurers view older applicants as a higher risk. Men generally pay a slightly higher premium than Women as life expectancy is a little longer for most Women.

Health Condition – Certain conditions can lead to higher premiums, but it'll never get less expensive or easier to qualify for than today.

Coverage Amount – The higher the death benefit (e.g., $50,000 vs. $10,000), the more you’ll pay in premiums.

Smoking Status – Smokers typically pay significantly higher premiums due to their increased health risks. Conditions such as COPD.

Payment Frequency – Some insurers charge more if you choose monthly payments instead of annual or semi-annual payments.

Can final expense insurance be used for expenses other than funeral costs?

Yes! Final expense insurance can be used for any purpose, not just funeral costs. The beneficiary receives the payout as a tax-free lump sum and can use it however they see fit.

Other common uses include:

✔ Medical bills – Unpaid hospital or hospice care expenses

✔ Credit card debt – Paying off outstanding balances

✔ Mortgage or rent – Helping a spouse or family stay financially stable

✔ Legal fees – Handling probate or estate administration costs

✔ Living expenses – Providing extra financial support for loved ones

✔ Charitable donations – Leaving money to a favorite charity or organization

Call Us Now To Review Plans

As an Insurance Brokerage, we partner with the Top A-Rated Carriers that offer these special Final Expense plans. We can shop around and find the BEST plan for you, at the lowest rate available. Most other Agents are only able to offer plans through a few companies.

Apply for Coverage and get Approved!

After thoroughly reviewing your needs and deciding the amount of coverage you might need, we will ask you a few simple and basic health questions that will allow us to determine what plans you qualify for.

I've been Approved, is there a Waiting Period?

NO - all plans have immediate Death benefits and also cover you for the full face amount if you pass away from a covered accident. You can also elect to receive a portion of the death benefit is you ever get diagnosed with a terminal illness in the future.

Your Trusted Partner in Final Expense Insurance

We specialize in final expense insurance, offering tailored solutions to ensure your family's financial security.

Our whole life policies help cover burial and other expenses, so your loved ones won't face financial burdens.

Experience personalized service and expert guidance to choose the best plan for your needs.

Discover the advantages of working with Final Expense Solutions.

We prioritize your family's future with comprehensive insurance options.

Expert Guidance

Professional support from experienced insurance brokers who understand final expense coverage.

Tailored Policies

Customized whole life insurance policies to meet your family's specific needs.

Affordable Premiums

Competitive pricing to ensure your coverage fits your budget.

Peace of Mind

Secure your family's financial future with our reliable insurance solutions.

Protect Your Loved Ones

It is crucial to consider the financial implications of your passing on your family and friends. Can they realistically gather $10,000 or more within 48 hours? Additionally, if a relative resides with you, are they financially equipped to handle ongoing living costs in your absence? By failing to plan ahead, you risk leaving your loved ones burdened with debt or struggling to maintain their housing situation after your departure. It is imperative to recognize that the current conditions for securing financial arrangements will likely never be more favorable or accessible than they are at this moment. By taking proactive steps to address these critical concerns, you can provide your family with peace of mind and significantly alleviate potential hardships during an incredibly difficult period in their lives. Your thoughtful planning today can serve as a lasting gift of love and security for those you care about most.

17

Years in Business

9k

Policies Sold

$18,000,000

Death Benefits Paid

Final Expense Solutions

Affordable Peace of Mind

©2025 Copyright. All rights reserved.

Final Expense Solutions is a Licensed Privately owned Agency contracted to offer Life Insurance, Medicare Plans, Property & Casualty and other Life & Health related policies. All policies are issued through State-regulated admitted carriers based on their underwriting guidelines and proposed rates and [they] have the right to decline coverage. All premiums are paid directly to the carrier that has offered coverage, no fees or commissions are being paid to Final Expense Solutions or it's Agents from premium payments. Not affiliated with or endorsed by the U.S. Government or the Federal Medicare Program. You consent to receive phone calls and SMS messages from Austin to provide updates and information regarding your business with Final Expense Solutions, Senior Benefits Advisors, Burial Life Group.<meta name="robots" content="noindex">

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.